Hong Kong's residential property market is facing the threat of default shocks that could derail its recovery, S&P Global Ratings says.

The agency warned that any high-profile defaults or restructurings by a major developer would squeeze industry funding, with effects rippling through the sector, hurting even highly rated names.

It noted that speculation around credit pressures on a number of local developers is building in the Hong Kong market.

New World Development’s (0017) finances remains a key concern.

Recommended

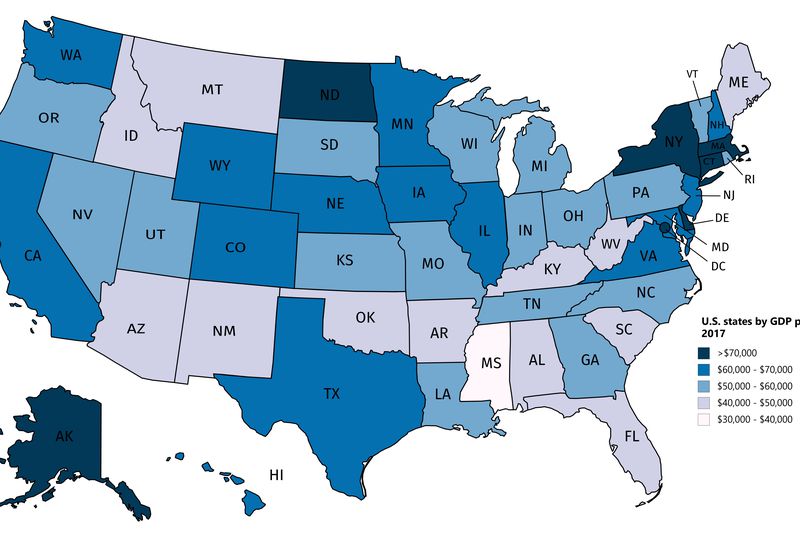

West Coast vs. East Coast Economy: Which Is Bigger?

Is Deflation Bad for the Economy?

The Fed’s Rate Hikes Have Yet to Dent Hiring

Minimal exposure for Hutchison if its Panama operations canceled